Starting a new business can be quite challenging. There are a lot of elements that need to be taken care of. Passion and determination play a huge role in a successful business. But at the same time, certain fundamental elements need to be seen as well. No matter what aspect you are focusing on in a business, it needs to be planned with great importance and attention.

Finance and accounting can be difficult and intimidating even for people who have rigorously studied business. Making sure that the financial side of your business is running smoothly is one of the most difficult tasks. And, challenges are seen throughout the course of any business venture. One thing that can proactively be of assistance is to find an accountant for small business. But other than that, we also have a few fundamental aspects of finance that you need to be acquainted with.

#1 Business plan

It is extremely vital to have a business or financial plan while constructing a business. Doing so will help navigate day to day business tasks and decision making. It is a great help for any business to be able to compare the forecasted number with the results that are actually achieved. This gives away the financial health of the companies. It also provides information which is important for other business operations. Financial planning allows you also to allocate funds where and when it is necessary.

Without financial planning, both for the present and the new future, it is impossible for a business to run smoothly. With the lack of financial planning, it is almost impossible to have a business which is financially stable. A great way to come up with a business plan is to find an accountant for small business and have him do the necessary tasks for you.

#2 Revenue and Costs

When we talk about revenue, it refers to the gross receipts which your company generates for the services it provides or the sales that it makes. These revenues are also referred to as operating revenues because your revenue predominantly comes from these revenues. The cost of revenue refers to the costs of the goods sold and the services that are delivered. Every company incurs costs because they have to deliver goods and services. Also, they have to pay their employees. Paying attention to the revenue and costs will help you understand and project the profits that your company could attain as well. Hence, it is vital to find an accountant for small business who could pay attention to your revenue and costs.

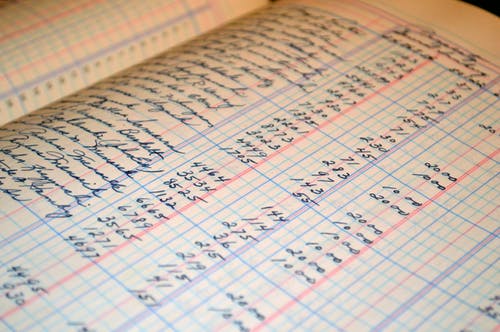

#3 Bookkeeping

Booking is used in order to maintain an accurate financial record of your company. If you are able to find an accountant for small business who can take care of your booking, it could prove of great help. Bookkeeping help business budget. This is because it helps the company to review its expenses and how it can be improved. It can be used as a roadmap for your company and help you accordingly. Bookkeeping also helps to tax your personal tax preparations. In addition, it also helps keep your business organized.

#4 Cash flow

Cash flow is basically the cash that flows in and the cash that flows out of business during a specific period. Paying attention to cash flow will help have a better understanding and analysis of company finances. It helps in the management of the company and also the short-term planning that is required.

The statement that the financial manager makes to predict the flow of cash that will take place in the near future becomes better. In addition, it also allows you to have detailed records of where the money has been spent. This way, you could always look back at the expenditure of the company if need be. It is important to find an accountant for small business who can at least take care of your cash flow statement.

#5 Payroll

Payroll defines the total amount of wages paid to the employees. In order to process payroll, it is important to maintain accurate records of the employees such as their work time, bonuses and their overtimes as well. Payroll has a significant impact on quite a few factors of the company. And here’s why it is important for a business that is both small and big:

- The moral of the employees

- Financial health

- Business reputation

- Compensation packages

Being able to find an accountant for small business can get you to help with taking care of your company’s payroll. Hence, making things much more smooth sailing and organized.

#6 Taxes

It is often said that if you want your business to be successful, it is important to have a strong tax strategy which is effective. If you have a solid tax strategy that takes advantage of legal loopholes, it can be a great help to any business. Tax policy will help reduce any liability and hence, in turn, increase the profits of the company.

Tips for incorporating in your small business

Other than these six fundamentals, there are also a few tips which you can be incorporating into a small business. All you need to do is find an accountant for small business and have him carry out certain tasks.

- Always beginning with a business plan can help provide a more organized approach. It can also help the company create proactive solutions for problems that may occur.

- Find an accountant for small business who can help decide on a bookkeeping method and accounting software.

- Pay attention and have control over the company’s cash flow.

- Keeping receipts and other important documents.

- Find an accountant for small business or a financial adviser.

There are a lot of small things that need to be taken care of when you are a new business owner. But, your finances are as important as anything else. If your company isn’t financially strong, your company won’t sustain any of the challenges it might have to face unexpectedly. Hence, having a professional on board on having to find an accountant for small business is a great idea. If you are looking for an accounting firm to ease out your business finance department, My CFO is a perfect choice! The professionals at the firm are experienced as well as well-qualified. Thus, it can help you make smart financial decisions.